Parties and Candidates

- Details

On this page

- Overview

- Electoral reforms

- Public funding

- Appointing an agent

- Prescribed details

- State campaign accounts

- Expenditure caps

- Reporting and disclosure obligations

- Types of funding

- By-elections

Overview

The Electoral Commission of South Australia (ECSA) provides funding to support election-related activities under the Electoral Act 1985 (the Act). This includes funding for registered political parties, independent MPs, candidates, and groups. All payments are indexed annually in line with the Consumer Price Index (CPI).

Key funding streams

- Public funding - including advance payments to support campaign activities

- Administrative expenditure funding - covering operational costs, with options for one-off payments

- Policy development funding - to assist in the formulation of party policies.

👉 See funding and disclosure information specific to political parties.

Electoral reforms

From 1 July 2025, the Electoral (Accountability and Integrity) Amendment Act 2024 introduced reforms to South Australia’s electoral framework to strengthen transparency, accountability, and integrity in electoral funding and political donations.

To support stakeholders, ECSA will provide ongoing guidance to assist participants in understanding their obligations under the new legislation; however, independent legal advice is encouraged.

Public funding

Public funding supports registered political parties, candidates, and groups in covering costs associated with state election campaigns and by-elections. The amount of funding is calculated per eligible vote and varies depending on the participant’s type and parliamentary status.

Eligibility

To qualify for a payment of public funding, candidates, groups, and registered political parties must meet specific eligibility criteria:

- Candidates: Must be elected or receive at least 4% (House of Assembly) or 2% (Legislative Council) of total primary votes.

- Groups: Must have at least one elected member or receive at least 2% of total primary votes (Legislative Council).

- Registered political parties:

- Must have been registered for at least 8 months prior to the election.

- Must meet vote thresholds similar to candidates and groups.

- Must provide satisfactory evidence of political expenditure to receive funding.

- Must operate a state campaign account for managing public funding and electoral expenses.

Funding entitlement

Public funding is calculated per eligible vote and varies depending on the type of participant and their parliamentary status. There are 2 types of entitlements: standard and tapered.

| Candidate or group type | Entitlement type | Funding rate (2026 indexed) |

|

Endorsed by a registered political party with at least one MP at dissolution |

Standard |

$5.50 per eligible vote |

| Endorsed by a registered political party with no MPs at dissolution |

Tapered |

$6.00 per vote for first 10% of total primary votes $5.50 per vote thereafter |

| Independent candidate or group with a sitting MP at dissolution | Standard | $8.50 per eligible vote |

| Other independent candidates or groups | Tapered | $9.00 per vote for first 10% of total primary votes $8.50 per vote thereafter |

Important:

- Funding is limited to actual political expenditure incurred.

- No payment will be made without satisfactory evidence of political expenditure.

Appointing an agent

Agents manage funding and disclosure obligations and ensure compliance with the Act.

👉 See our agents page for details.

Prescribed details for returns

Under the Act, all participants required to lodge returns, including registered political parties, third parties, associated entities, and their agents, must include prescribed details to meet funding and disclosure obligations.

State campaign accounts

Required for managing donations, public funding, and political expenditure. Must be opened with an authorised bank and registered with ECSA.

Expenditure caps

Expenditure caps apply to political participants during election periods. These rules help ensure fairness and transparency in campaign spending.

- Spending limits apply from 1 July before the election to 30 days after polling day.

- Participants spending over $5,000 must lodge a capped expenditure return within 60 days after polling day.

👉 See our expenditure caps page for details.

Reporting and disclosure obligations

Political participants must meet specific reporting requirements under South Australian electoral law. These obligations ensure transparency in campaign financing and political expenditure.

Relevant links:

Types of funding

Advance funding

Provides early access to public funds before polling day. Requires eligibility certification and may require repayment if conditions aren’t met.

👉 Learn more on our advance funding page.

👉 For detailed information, see:

By-elections

Advance public funding is available in a House of Assembly by-election, but only under strict conditions.

👉 Learn more on our advance funding page.

Administrative funding

Administrative funding (formerly known as special assistance funding) is a form of public funding provided under Division 5 of the Act. It is paid as a half-yearly entitlement to eligible registered political parties and independent members of parliament to assist with the reimbursement of administrative expenditure.

Funding is available to:

- Registered political parties with one or more members in the South Australian Parliament (House of Assembly or Legislative Council)

- Independent members of parliament.

Policy development funding

Reimburses registered parties for policy-related expenses incurred during the financial year.

- Details

On this page:

- Definitions

- Authorisation requirements

- Restrictions on display of electoral advertisements

- Headings on electoral advertisements

- Misleading advertising

- How-to-vote cards

- Broadcast media authorisations

- Digital advertising

- Artificial intelligence (AI)

This page provides guidance on the legal requirements for electoral advertising during South Australian state elections. All candidates, parties, and third-party campaigners must comply with the Electoral Act 1985 (Electoral Act) and associated Electoral Regulations 2024 (Electoral Regulations).

References

- Broadcasting Services Act 1992 (Cth)

- Electoral Act 1985 (SA)

- Electoral (Control of Corflutes) Amendment Act 2024

- Electoral (Miscellaneous) Amendment Act 2024

- Electoral Regulations 2024

- Local Government Act 1999

- Guidelines for the broadcast of political matter (Australian Communications and Media Authority (ACMA))

Definitions

Electoral Act - Part 1, section 4.

- Electoral advertisement: An advertisement containing electoral matter.

- Electoral matter: Matter calculated to affect the result of an election.

Note: The Electoral Commission of South Australia (ECSA) cannot provide legal advice. If you're unsure about your obligations, we strongly recommend seeking independent legal advice.

Authorisation requirements

Under section 112 of the Electoral Act, any electoral advertisement, whether printed or published online, must include:

- Name and street address of the authoriser (a PO Box cannot be used).

Note: Independent candidates (those not endorsed by a registered political party) may use a PO Box instead of a street address if they have approval from the Electoral Commissioner and the suburb where the candidate lives is included at the end of the advertisement. - If authorised for a registered political party or an endorsed candidate: the party's name or its registered abbreviation.

- If authorised for a relevant third party: the name of that third party.

Exceptions: Small items such as stickers, badges, lapel buttons, pens, pencils and balloons are exempt.

Compliance note: Failure to include correct authorisation details is an offence.

Maximum penalty: $5,000 for individuals, $10,000 for bodies corporate.

Restrictions on the display of electoral advertisements

Section 115 of the Electoral Act and the Electoral (Control of Corflutes) Amendment Act 2024.

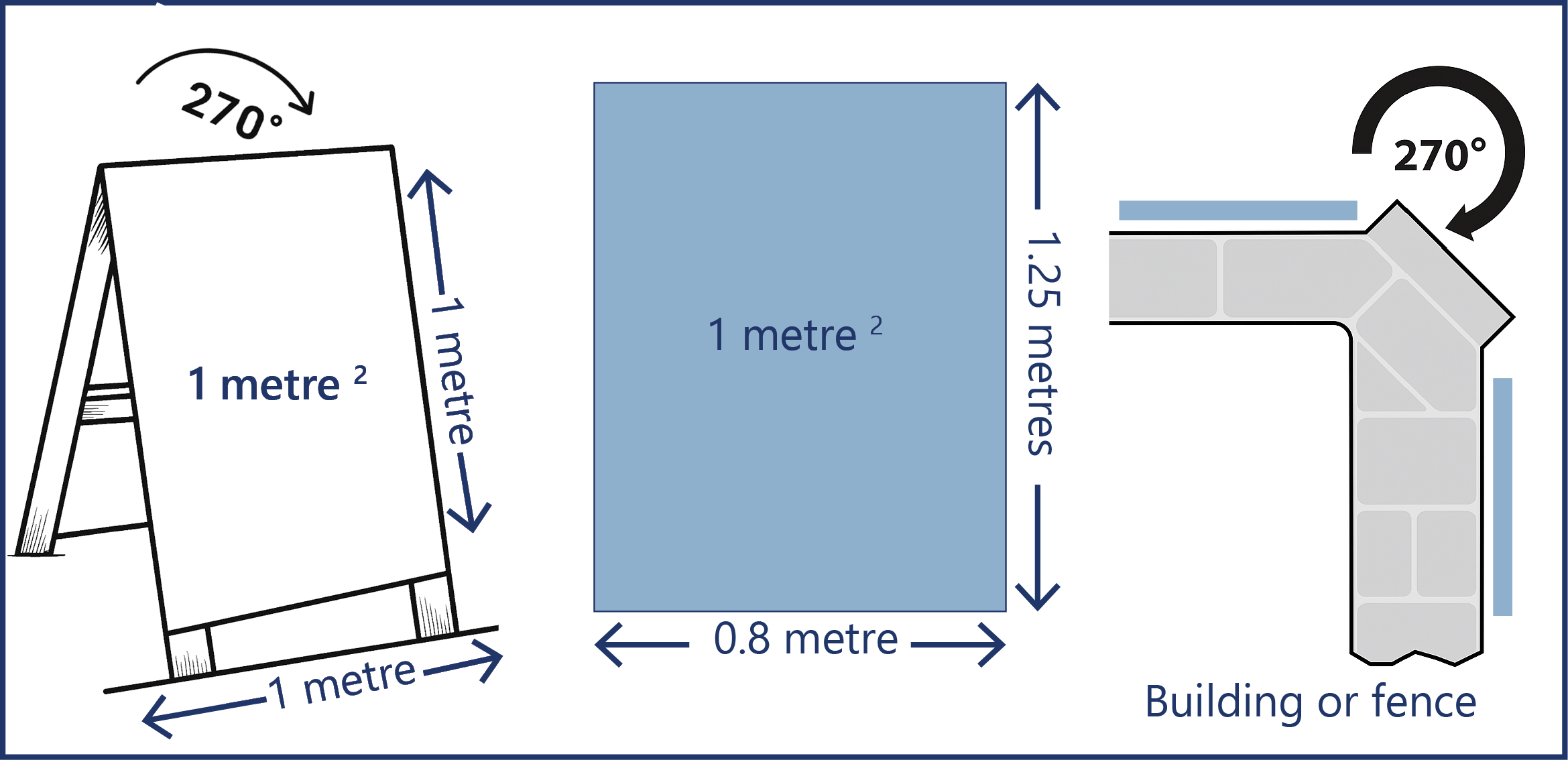

Size of electoral advertisements

- Advertisements on vehicles, buildings, hoardings, or structures must not exceed 1 square metre.

- Advertisements within 1 metre of each other for the same candidate or party are treated as a single advertisement.

Penalty: Up to $5,000.

Prohibited locations

- It is prohibited to exhibit electoral advertising posters on public roads or road-related areas, including structures, fixtures, or vegetation.

Penalty: Up to $5,000.

Exceptions

- Posters held by a person (directly or attached to a device).

- Posters not attached to a structure, displayed at or near a designated event or activity immediately before, during, or after (maximum 6 hours).

- Posters of a prescribed kind or in prescribed circumstances under regulations.

Compliance note: Significant penalties apply for breaches of size and placement rules under section 115.

Enquiries about the placement of signs in public spaces (e.g. height, location) should be directed to the relevant council, as these matters fall under the Local Government Act 1999.

Headings on electoral advertisements

Part 13, Division 2 of the Electoral Act.

All electoral advertisements must clearly identify the candidate or party they promote. Headings should not mislead voters about the source or purpose of the advertisement.

Misleading advertising

Under section 113 of the Electoral Act, it is an offence to publish electoral material that contains statements of fact that are inaccurate and misleading to a material extent.

Maximum penalty: $5,000 for individuals, $25,000 for bodies corporate.

The Electoral Commissioner may require withdrawal or publication of a retraction.

How-to-vote cards

Part 6 of the Electoral Regulations.

How-to-vote cards must comply with authorisation requirements and must not mislead voters. They should clearly indicate the candidate or party issuing the card and follow the official ballot format.

Broadcast media authorisations

Section 112 of the Electoral Act and the 'Guidelines for the broadcast of political matter' (Australian Communications and Media Authority (ACMA)).

- Radio advertisements must include a spoken authorisation at the end of the advertisement. This format requirement is governed by federal broadcasting regulations, including the Broadcasting Services Act 1992 and ACMA guidelines.

- Television advertisements must include both a spoken and a text-based authorisation at the end of the advertisement. Also governed by federal broadcasting regulations.

While section 112 of the Electoral Act outlines the content of the authorisation (i.e., what must be included), the formatting requirements for broadcast media are set by federal law and apply nationally, including in South Australia.

Digital advertising

Online and social media advertising must comply with authorisation requirements. Paid digital ads may be subject to additional disclosure obligations under the Electoral Act.

Artificial intelligence in electoral advertising

Under sections 115B to 115D of the Electoral Act, it is prohibited to publish or distribute electoral advertising generated by artificial intelligence that falsely depicts a person performing acts they did not do.

Penalty: Up to $10,000 for breaches.

Consent exception: Allowed only if the person depicted has given written consent and the advertisement is clearly labelled as AI-generated.

The Electoral Commissioner may order removal of such ads and require corrective statements.

- Details

On this page

- Overview

- Purpose

- Eligibility

- Use of funds

- Funding amounts

- Administrative funding payments

- One-off payments

- Repayments

Overview

Administrative funding (formerly known as special assistance funding) is a form of public funding provided under Division 5 of the Electoral Act 1985 (the Act). It is paid as a half-yearly entitlement to eligible registered political parties and independent members of parliament to assist with the reimbursement of administrative expenditure.

Before the amendments introduced by the Electoral (Accountability and Integrity) Amendment Act 2024, public funding provided under Division 5 of the Electoral Act was known as special assistance funding.

👉 View historical special assistance funding.

For detailed instructions and legislative references, see the Administrative Funding Guide.

Purpose

Registered political parties and independent members of parliament may be eligible to receive administrative funding. This funding is to cover administrative expenses, including:

- Administration, operation or management of the activities of the party or member.

- Communication with members of the party on administrative, operational or management matters.

- Conferences, seminars, and meetings at which policies are discussed or formulated.

- Complying with the Act and auditing of financial accounts.

- Expenditure and remuneration of staff.

- Training of staff and volunteers.

- Equipment or vehicles whilst engaged in the matters referred to above.

- Office accommodation for staff and equipment.

- Expenditure on interest payments on loans.

Eligibility

Registered political parties

To be eligible for administrative funding, a registered political party must:

- Have at least one member in the South Australian Parliament (House of Assembly or Legislative Council) during the period.

- Be registered on the polling day of the most recent general election.

- Remain registered for the entire funding period.

Special rule for 2025

Despite section 130 U(1)(b)(ii) of the Act, a registered political party will still be considered eligible for the July—December 2025 half-year period if:

- it was registered on or before 1 August 2025, and

- It stayed registered until 31 December 2025.

Independent members of parliament

Independent members of parliament are also eligible for administrative funding.

Who is not eligible

- Parties with no members in either the House of Assembly or Legislative Council.

Use of funds

- Administrative funding must not be paid into a state campaign account.

- Administrative funding must not be used for political or electoral expenditure.

- Two or more registered political parties cannot rely on the same person for entitlement to, or payment of, administrative funding.

How to apply

- Complete the administrative expenditure funding application form within 30 days of the end of the period.

- Return the completed form by email to

This email address is being protected from spambots. You need JavaScript enabled to view it.

Funding amounts

Payments are made twice a year (half-yearly) and are indexed annually in line with the Consumer Price Index (CPI).

Payment structure

| Recipient type | Elected members | Funding amount (half-yearly) |

|

Registered political party |

1 member |

$85,000 |

|

Registered political party |

2 members |

$245,000 |

|

Registered political party |

Each additional member (beyond 2) |

$55,000 (capped) |

|

Registered political party |

Maximum funding |

$800,000 |

| Independent member of parliament | 1 member | $20,000 |

View administrative funding payments by period

👉 Half-yearly payments made to eligible parties and independent members

One-off payment

Purpose

- Provides reimbursement for one-off costs including costs related to meeting funding and disclosure obligations.

- Recognises that reforms may create additional administrative burden for parties and independent members eligible for administrative funding.

Availability

- From 1 July 2025 to 3 August 2026.

How to claim

- Paid on receipt of a one-off administrative funding claim form.

Funding limit

- Registered political parties – up to a maximum of $200,000.

- Independent members of parliament – up to a maximum of $50,000.

If you have already claimed administrative funding, you cannot claim the same expense as part of this one-off payment.

Repayment of funds

The Electoral Commissioner may require repayment of unspent administrative funding in the following circumstances:

- Did not contest the election.

- Ceases to operate, becomes unregistered, or a seat becomes vacant.

- Changes status, such as:

- A non-party member joining a registered political party.

- Standing in an election for a registered political party.

- Details

On this page

- Donations

- Campaign donation returns

- Donor disclosure requirements

- Loan restrictions

- Additional disclosure obligations

- Offences and penalties

Disclosure Timetable - 2026 State Election

Under Part 13A of the Electoral Act 1985 (the Act), candidates and groups participating in elections must meet specific reporting requirements related to campaign financing and political expenditure. These obligations ensure transparency and accountability in electoral funding.

Donations to certain participants

While Subdivisions 1 and 2 of the Act establish broad prohibitions on political donations and loans, Subdivision 3 introduces specific rules for regulated designated participants. These participants may still receive donations and loans within strict limits, such as a $5,000 individual cap per financial year, provided they comply with disclosure and return requirements.

👉 See our donations to certain participants page for details.

Campaign donations returns

(section 130ZF)

The agent of each entitled candidate or entitled group must lodge campaign donation returns at prescribed times during the election cycle. These returns must be submitted in a form approved by the Electoral Commissioner.

Returns must include

For donations or loans over $1,000:- Amount or value

- Date received

- Name and address of the donor or creditor

- Total value

- Number of donors or lenders

Exemptions

- Donations or loans made privately for personal use and not used for election purposes are exempt from disclosure.

Disclosure period

- New candidates: Begins on the day they announce or are nominated.

- Returning candidates: Begins 30 days after polling day of the previous election they contested.

- Groups: Begins on the day they apply to be grouped on the ballot.

- The period ends 30 days after polling day of the current election.

Prescribed lodgement times

Returns must be lodged:

- Within 30 days of the end of the period from the start of the disclosure period to the start of the designated period.

- Within 5 days of the end of the first 30 days of the designated period.

- Every 7 days thereafter until 30 days after polling day.

- A final return must be lodged within 5 days of the end of the designated period if fewer than 7 days remain.

Donor disclosure requirements

(section 130ZG)

Individuals who donate or loan more than $1,000 (up to the legal cap of $5,000) to candidates or groups during the disclosure period must lodge a donor return, unless they are a registered party, associated entity, candidate, or group member

What must be included

Donor returns must include

- Details of donations or loans made, including:

- Amount or value

- Date made

- Name and address of the recipient

- Details of funds received and used to make or reimburse those donations or loans:

- Amount or value

- Date received

- Number of contributors

Lodgement deadlines

- If the donation or loan was made before the designated period, within 30 days of the start of the designated period.

- If the donation or loan was made during the designated period, within 7 days after the end of the designated period.

Agent responsibilities

Agents must inform donors of their obligations to lodge a return if applicable.

Loan restrictions

(section 130ZK)

Candidates, groups, and their agents must comply with strict rules regarding loans received during election periods.

Key requirements

It is unlawful to receive a loan of $500 or more from a person other than a financial institution unless detailed records are kept.

Required records include:

- Terms and conditions of the loan

- Name and address of the lender

- Additional details if the lender is:

- A registered industrial organisation

- An incorporated or unincorporated association

- A trust fund or foundation

- A body corporate (including board members and related entities).

These obligations continue for 30 days after polling day.

Penalties

- Unlawful loans must be repaid to the Crown

- In the case of unicorporate bodies, executive committee members are jointly and individually liable.

Additional disclosure obligations

Candidates, groups, and other electoral participants may be subject to further disclosure obligations under sections 130ZQ to 130ZT of the Act. These provisions apply when political expenditure exceeds certain thresholds or when amounts are received to fund such expenditure.

Political expenditure during capped expenditure period

(section 130ZQ)

- Applies to candidates and groups incurring more than $5,000 in political expenditure during the capped expenditure period.

- Agents must submit a return within 60 days after polling day, detailing the expenditure

Annual political expenditure returns

(section 130ZR)

- Applies to candidates and groups incurring more than $5,000 in political expenditure during a financial year, not acting on behalf of the Crown or as a member of parliament.

- Returns must be submitted within 12 weeks after the end of the financial year.

Annual returns for amounts received

(section 130ZS)

- Applies to candidates and groups required to submit returns under 130ZQ or 130ZR who received amounts over $1,000 used for political expenditure.

- Returns must include:

- Value and date of each amount

- Name and address of the contributor

- Any other prescribed details

- Aggregated amounts from the same donor are treated as one.

Offences and penalties

Candidates and groups must comply with all obligations under Part 13A of the Act. Breaches may result in offences and legal penalties, as outlined in section 130ZZE and Regulation 40 of the Electoral Regulations 2024.

Failure to lodge required returns

Not submitting election period returns, donation and loan disclosures, or audit certificates within the required timeframe is an offence.

Providing false or misleading information

Knowingly submitting incorrect or incomplete information in a return is a serious offence.

Failure to appoint an agent

Each candidate or group must appoint an agent to manage electoral obligations. If no agent is appointed:

- The candidate or group members may be held personally responsible..

- Non-compliance by the agent or responsible persons may result in penalties.

Failure to maintain a state campaign account

If a candidate or group receives funds that must be deposited into a campaign account and fails to do so, this may breach the Act.